At a Glance

-

-

Requirements: Level 4 AAT

-

Prices vary: employers will often cover the cost of training

Benefits

-

Less time to qualify

-

Build on existing knowledge and skills

-

Fewer exams

What is the AAT-ACA Fast Track?

Developed with AAT, the AAT to ACA Fast Track is a quick and efficient route into chartered accountancy after Level 4 AAT.

Instead of starting the ACA qualification from scratch, this route allows you to skip some training steps towards qualifying as an ICAEW Chartered Accountant, as you will have covered similar ground through your Level 4 AAT qualification.

Your AAT exams, prior work experience, knowledge and skills mean you may be able to accelerate (or fast-track) towards chartered accountancy.

What can be fast tracked?

Exams

The ACA qualification consists of 15 modules/exams.

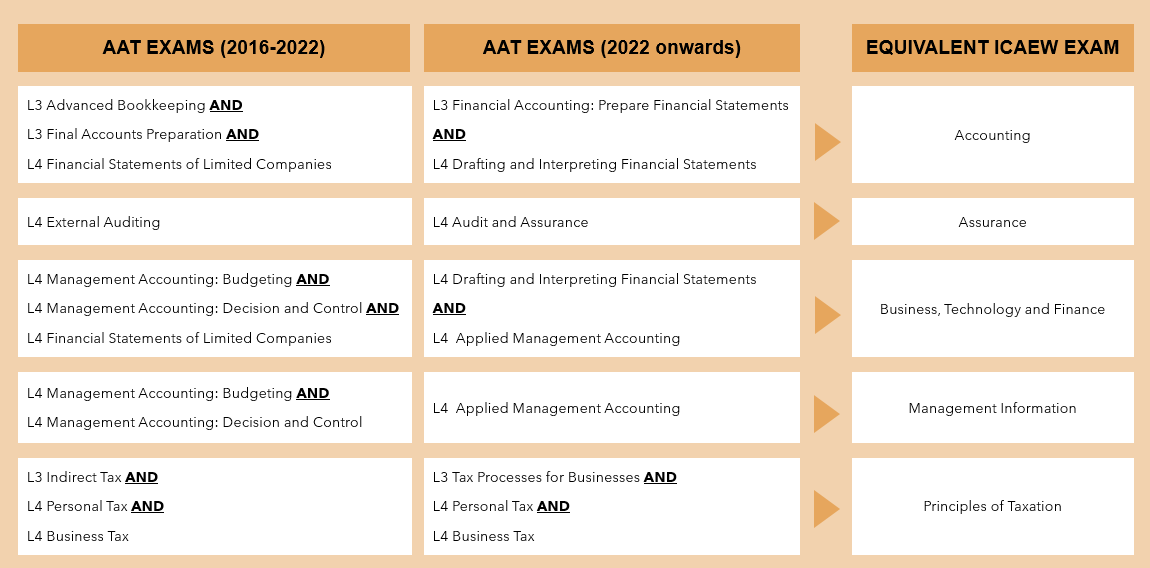

With the Level 4 AAT qualification you could gain credit for up to five of those modules at the first stage of the ACA, also known as the Certificate Level.

Below, you can see the five ACA modules, and the corresponding AAT exams you need to have completed to be able to claim credit for prior learning.

Work experience

In order to fully qualify with ICAEW, you need to complete 450 days of work experience in a training agreement with an ICAEW Authorised Training Employer. An Authorised Training Employer (ATE) is essentially any organisation that has gained the right to train ICAEW students.

If you are studying for your Level 4 AAT qualification or completed it whilst working at an ICAEW Authorised Training Employer*, you could claim up to one year of work experience when you start the ACA.

If you are still studying for your AAT qualification, and are employed by an ATE, great – you’ll be able to claim up to 12 months’ work experience. Not with an ATE? No worries – they can become authorised via a simple, and free, process.

*Not sure if your employer is an ATE? Please contact our Student Support team to find out.

RESOURCES

Join one of our AAT-ACA sessions

If you’d like to find out more information, then join one of our free live AAT-ACA sessions, taking place every month, where a member of the ICAEW team will explain the route and answer your questions.

Information for your employer

We have a dedicated area for employers where they can find out more about the route, how they can support you and how they can become authorised to train you on the ACA.

Please feel free to share the link below with your employer.

The AAT-ACA newsletter and personalised email

Sign up to our monthly newsletter to further explore chartered accountancy. If you are at or have completed Level 4 AAT, you will also have the option to receive a one-off personalised email.

ICAEW, we get you there

Starting point

As AAT-qualified or whilst you’re studying or are about to study the Level 4 AAT.

Step 1

If you’re not employed – Have a look at our ICAEW Training Vacancies website, where ATEs advertise their vacancies. You can also find an employer of your choice, and get them authorised. If you are employed – If you’re staying with your current employer, now is the time to get them authorised. (You can also start this process when you’re close to completing your Level 3 AAT, so you can claim work experience later.)

Step 2

Check your eligibility for exam credits on our credit for prior learning directory.

Step 3

Complete the Level 4 AAT and start your ACA training.

Step 4

When you start the ACA, you can apply for credits for prior learning and work experience where relevant.

Step 5

Complete the ACA requirements. Depending on how many elements you were able to claim, it takes 2-4 years to fully qualify as an ICAEW Chartered Accountant.